hawaii tax id number 12 digits

Tax IDs issued before the modernization project had the letters W after them and 10 digits preceding them. Maui Island Business Owner Sentenced to Tax Violations MAUI On March 8 2022 former Maui resident Thomasene Kanaha-Barretto doing business as Quick Tow LLC was sentenced in a criminal case involving six counts of failure to file general excise tax returns GET for tax years 2013 to 2018 in violation of Hawaii Revised Statutes HRS Section 231-35.

Hawaii does not have a sales tax.

. Its the unique identification number assigned to each Hawaii tax account. 0000000000 10 digits Hawaii Contribution Rate. A Hawaii tax id number can be one of two state tax ID numbers.

Hawaii tax id number 12 digits. 3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. Even though applying online is universally the best application method there are some other methods to choose from.

It is an alphanumeric number that is 10 digits. Apply for a Hawaii Tax ID by Phone Mail or Fax. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

You should not enroll in autofile using a hawaii tax id that begin with abbreviations for other tax types such as co fr gs ps rv ta or wh. In this example W99999999-01 is capitalized. As the name suggests General Excise Use is used along with County Surcharging Tax in accounts.

A wholesale License is a sales tax ID number. The Tax ID or EIN serves as a way to easily identify the entity similar to how a Social Security Number is used to uniquely identify individuals. The state of Hawaii began a new process in 2017 that now requires a 12 digit business ID number.

Those tax IDs from before the modernization were imprinted with the letter W and followed by ten numbers. The example below is GE 9999-9999-01 with a number between zero and ten thousand. 1 Hawaii Sales Tax IDs with the letters GE beginning with them and followed by the next 12 digits are issued after a modernization project.

A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. The IDs were supposed to be mailed to you last year.

The GE account type stands for General ExciseUse and County Surcharge Tax. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits. A Hawaii tax id number can be one of two state tax ID numbers.

Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express. You can also look up the new one here httpshitaxhawaiigov_ Just enter the old ID you have Taxpayer name as listed on the. Due to the confidentiality of Social Security numbers DOTAX issues a specific tax account number for each taxpayer that does not have a Federal Identification number.

The GE account type stands for General ExciseUse and County Surcharge Tax. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. Individuals can register online to receive their.

The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. A Hawaii SalesTax ID is issued after the modernization project in which the words GE are repeated 12 times. W99999999-01 was created in99999999.

The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. Check sum with the following weighting coefficients is calculated. W99999999-01 Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

Its the unique identification number assigned to each Hawaii tax account. See Hawaii Tax ID Number Changes for more information. Tax IDs issued before the modernization project begin with the letter W and are numbered 10 through 20 as follows.

Filed on or before June 30 2017 Any Form N-848 filed on or before June 30 2017 that only requires the last four digits of the representatives SSN will remain valid and effective until December 31 2017. Apply for a Hawaii Tax ID Number. While it is referred sometimes as an Employer ID Number the EIN is used by businesses and other entities to identify the tax accounts of both employers as well as other entities that have no employees.

The Hawaii SalesTax IDs you receive will appear and read GE with another 12 digits following it after the modernization. W99999999-01 in that file. The Tax ID numbers issued prior to Hawaiis modernizing project are W followed by 10 digits in the original letter.

Instead we have the GET which is assessed on all business activities. A Hawaii SalesTax ID document is issued after its code which begins with the letter GE and is followed by the serial number is altered. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax.

Once youre done with the application you should receive your tax ID via email in an hour or less. Where can I look up my Hawaii Tax ID. If you did not get the mailer you can contact taxpayer services in the link below.

1 Hawaii SalesTax IDs issued as a result of the modernization project start with the words GE followed by twelve digits on their backs. Hawaii Business Express offers a Form BB-1 available online that individuals can fill out and receive their ID right away. Apply for a Hawaii Tax ID Number.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. Hawaii tax id number 12 digits. This is different from a Social Security number SSN or employer identification number EIN.

Tax Services Hawaiʻi Tax Online. Use this search engine to find the latest Hawaii Tax ID numbers for Cigarette and Tobacco Fuel General Excise Sellers. To learn more about the differences between the GET and sales tax.

Therefore the last four-digits of the specific tax account number issued by DOTAX are used on the billing notices rather than the last four digits of your Social Security. The example below is W99999999-01 for example. A two-letter account type identification and 12 digits mark the initial state tax ID number for Hawaii.

You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax.

3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format.

The Day The Earth Will Stand Still By Mykl Roventine Via Flickr Y2k Computer Crash Catastrophic Thinking Millennium

What Do I Need To Enroll In Autofile For Hawaii Taxjar Support

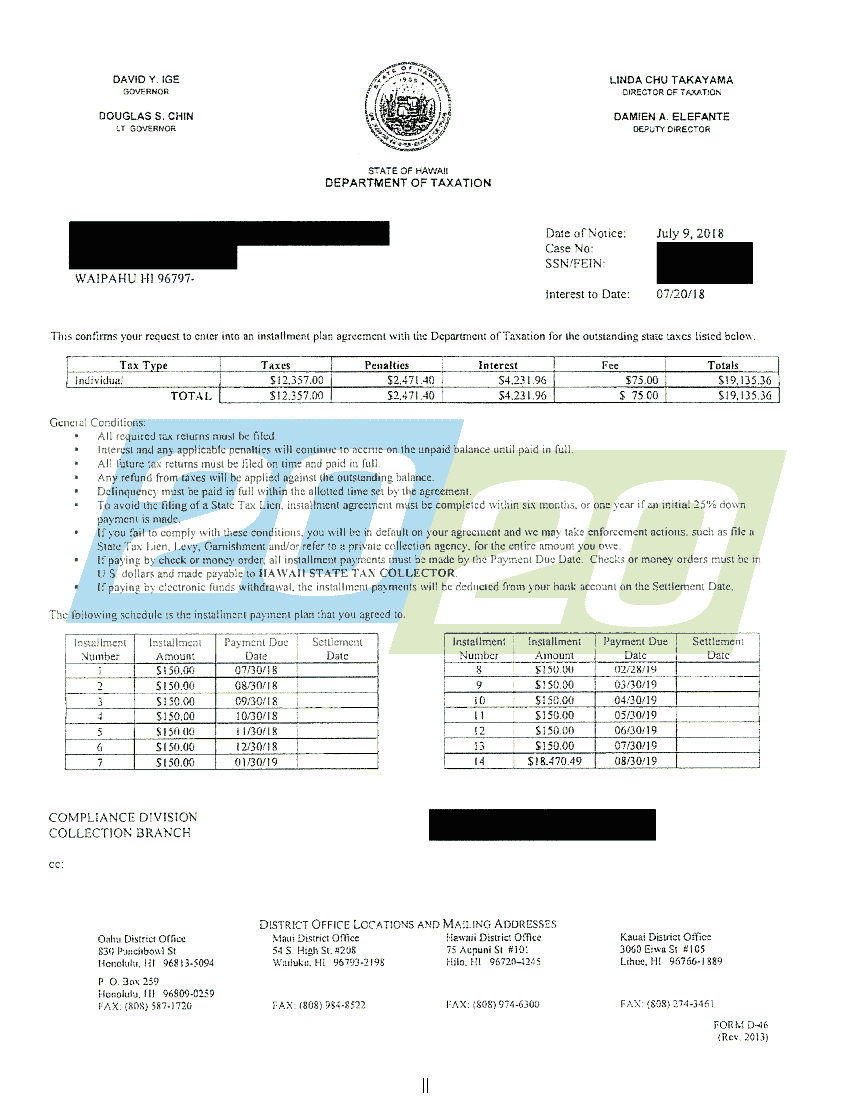

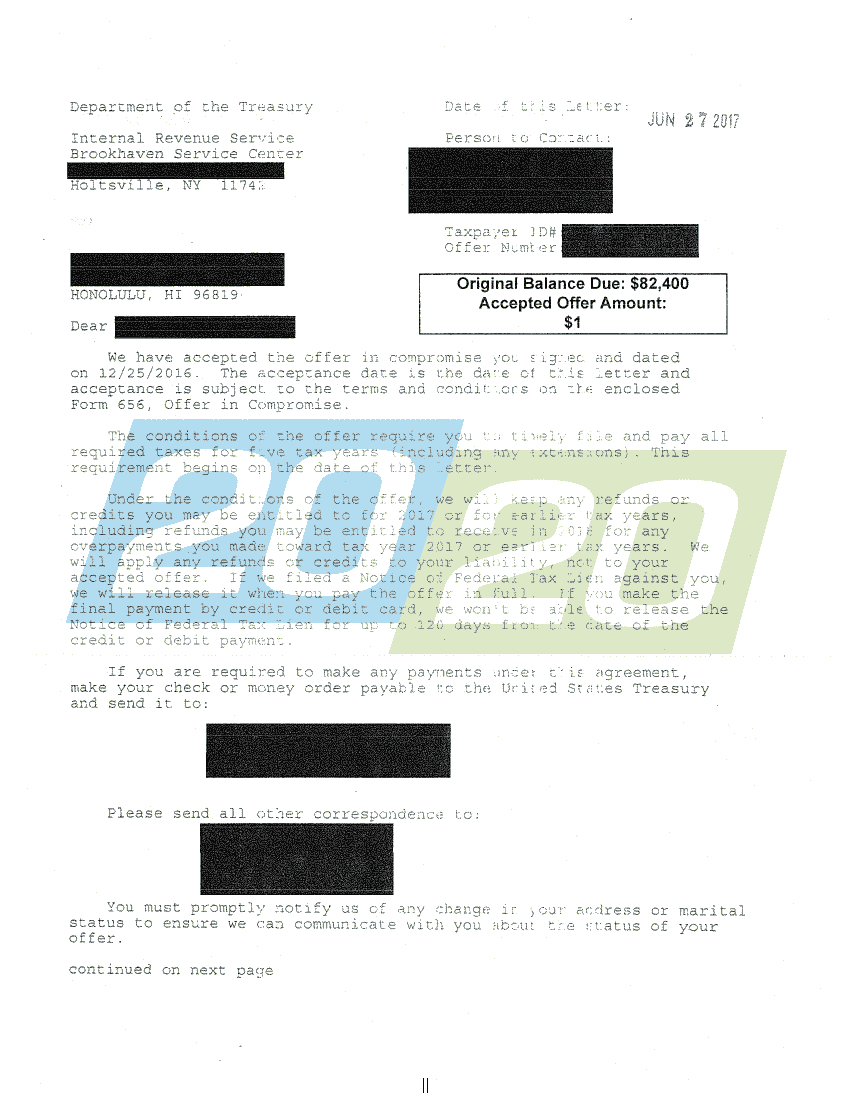

Tax Liabilities In Hawaii Fixed 20 20 Tax Resolution

60 Most Amazing Optical Illusion And Paradox Pictures You Must See Optical Illusions Illusions Words

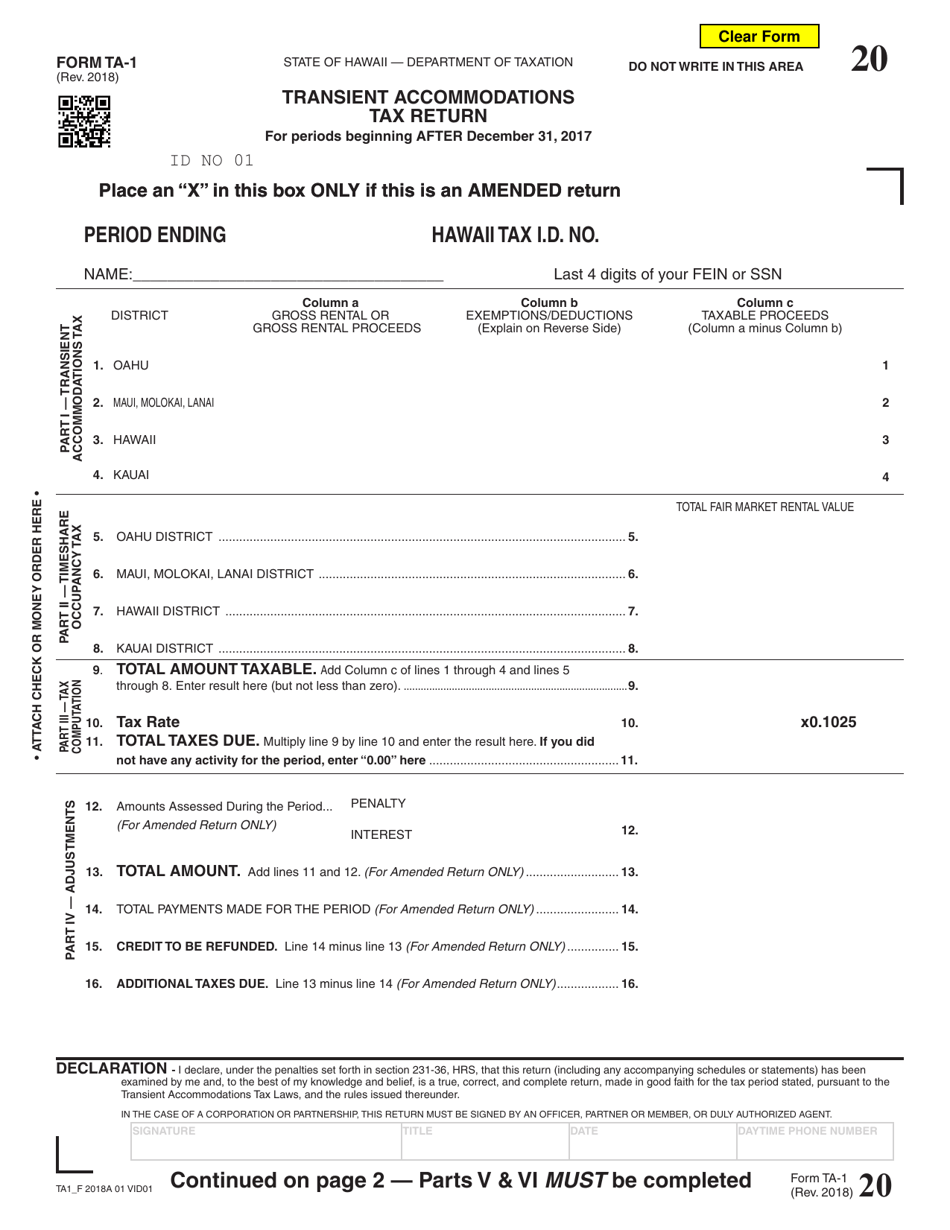

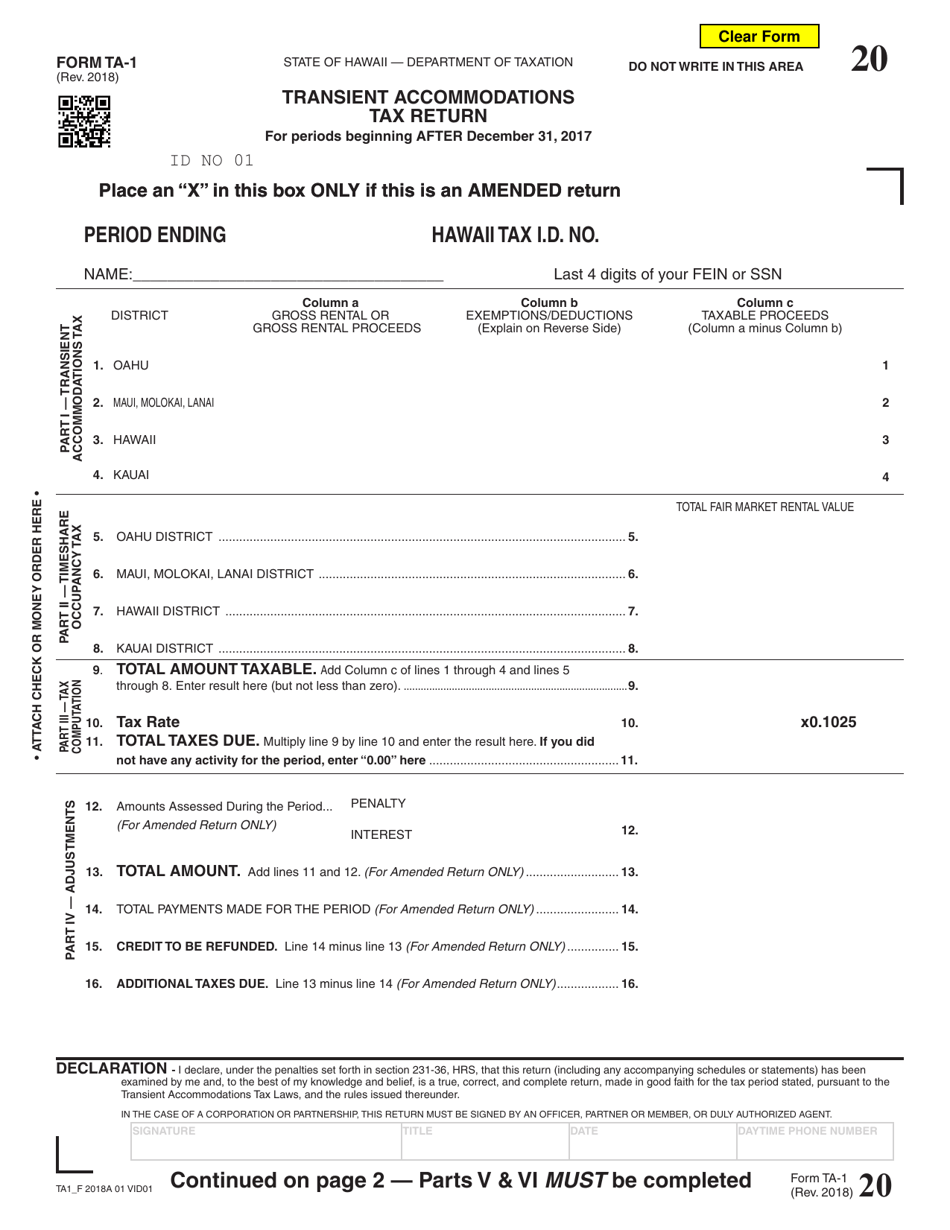

Form Ta 1 Download Fillable Pdf Or Fill Online Transient Accommodations Tax Return Hawaii Templateroller

Dual Rate Form Rv 3 Rev 2012 General Information Hawaii Gov

Tax Liabilities In Hawaii Fixed 20 20 Tax Resolution

Tax Liabilities In Hawaii Fixed 20 20 Tax Resolution

Dual Rate Form Rv 3 Rev 2012 General Information Hawaii Gov

State Of Hawaii Department Of Taxation Faqs

Hawaii Aloha State Frases De Amor Libros Placas Decorativas Carpeta

Why Delivering Government It Projects Can Be So Taxing

Tax Preperation On Oahu Executive Accounting Solutions

Coloring Dolphin Dolphin Coloring Pages Dolphins Coloring Pages